Can three different clients, with three different needs, have the same overall goal? Absolutely!

Often, these newsletters explain a project we've done or a concept we found useful and interesting. Also often, I can get caught up with the "how" and skimp on the "why". Not so this month!

I take it for granted that most executives, business owners, and managers have a good understanding of their profitability at the "macro" level of the Income Statement – however, I sometimes forget they may not have a way to zoom in and get a "micro" view of their profitability.

The overall goal of the three clients I'll describe this month was the same – to make more money. Different businesses, different industries, each wanting to achieve a better bottom line by having us examine the "micro" profitability of their goods and services. Not surprising to us, good old-fashioned Cost Accounting was THE key to each project's success

Boiling it down, here is what our three clients wanted:

- Know Product Costs

- Enforce Margin Requirements

- Evaluate Services Profitability

Alpha Co. – Know Product Costs

What happens when you're tracking only 20% of your total product cost to the job?

We were introduced to this client by a contract CFO, retained to help improve Alpha's bottom line. He quickly realized his only tools were the "macro" financial statements coming from QuickBooks.

- Specialized Materials bought specifically for a job, about 20% of the total product cost, were tracked to the job through QuickBooks.

- Stock materials – such as nails, screws, and plywood – comprised about 5% of the product cost. Pulled from items kept on hand, and were not tracked to the job.

- Labor, at about 75% of total cost, was NOT tracked to the job via any mechanism.

For this client, we developed a "micro" system measuring job costs and profits. It consisted of two parts:

- A simple Time Tracking application to allow employees to log time to both customer jobs and internal time codes.

- A small Data Warehouse housing job data and costs from QuickBooks, pulling information from the time tracking application, and producing various reports and analyses.

The Bottom Line – Armed with these two new tools, operations and financial personnel could finally determine each job's profitability and begin to improve Alpha's profits by:

- Improving the job estimation process,

- Identifying when change orders were appropriate, and

- Reducing overtime through better job planning and employee scheduling.

Beta Company – Enforce Our Margin Requirements

What happens when job quoting – including estimating costs and setting margins – is not consistent?

At Beta, estimates were done differently across multiple locations, and none of their seven different cost list was trusted fully. Beta's executives wanted to improve both "macro" and "micro" profitability and grow in volume too. Their vision was to improve the efficiency and effectiveness of customer-facing staff, and to implement a repeatable product and service process to expand business in a key market segment.

We helped bring this vision to life by ...

- Analyzing the seven different cost sources, and developing one single, highly-accurate costing methodology.

- Reviewing the entire process from initial encounter, to quote preparation and delivery, to product delivery and installation.

- Designing a "micro" system to track costs and improve profits by:

- Standardizing the quoting process,

- Embedding the validated costing methodology in the application,

- Enforcing adherence to target margins by customer category,

- Automating preparing the quote and emailing it to the customer,

- Tracking the status of opportunities, and

- Associating actual costs from QuickBooks back to the quote and estimate.

The Bottom Line – While this project is not yet complete, our client has already seen:

- Margins rise on individual jobs within the first month of rollout, because of consistent pricing and enforced margins.

- Profits grow for the division as a whole within six months of rollout.

- Bottom line improvement on track to recoup their investment in our services within 12 months.

Gamma, Inc. – Evaluate Services Profitability

What happens when you're so busy working IN the business, you don't have time to work ON the business?

Fast growth is good – until it strains cash and swamps the company president. Although not an engineer, Gamma's president could have easily been one, because he is able to estimate jobs and envision process improvement. We were referred to this client by both the president's executive coach and the company's external CPA – and on the same day!

Gamma has a very specialized clientele and highly seasonal work for a relatively small number of high-priced jobs. Our client makes money in two ways:

- Building Products in Its Shop – The shop stays fairly busy year-round, even during their off-season.

- Deploying Its Products at Events - Primarily using its own staff, Gamma coordinates the work of multiple vendors and contractors to get its product – and staff – to the event at the right time, and to deploy its products across multiple tightly-scripted events, often back-to-back throughout the season.

For one of Gamma's customers, the products and deployments serviced may be around 60% and 40%, respectively, of the total contract.

For its deployment services, product transportation and storage is about 5% of the total value, staff labor comprises about 60%, and the balance – about 35% – consists mainly of various out-of-pocket expenses. The challenge – Gamma charges its customers a single Daily Per Diem to cover lodging, transportation, meal allowances, and similar expenses, and this Daily Per Diem had never been validated.

Currently, we are helping this client in two distinct ways:

- Job Workflow Tracking – Routing each item through the shop and tracking its progress ensures repeatability and accountability. More importantly, this tracking will now identify products the customer requested AFTER the job was specified and quoted. Our client estimates this "Oops" factor could be a six-figure number per year because change orders had never before been tracked.

- Project Profitability – Gamma had never attempted to estimate the profitability of an individual project. Why? The reasons included a lean staff, a "macro" financial system with weak job tracking capabilities, and lack of knowledge on how to actually do this in a manageable fashion.

We worked with client personnel to devise a "micro" way to use the existing financial system, hourly payroll system, and credit card and travel systems to associate costs with specific projects. Additionally, we're developing systems to:

- Let salaried employees associate time with customer or internal projects.

- Create change orders for customer requests at events.

- Pull together costs and revenues, by project, to determine project profitability.

In the Project Profitability work, our client agreed with our proposed "Good Enough" philosophy. We're not trying to exactly tie the "micro" projects' profitability back to the "macro" Income Statement. Rather, we're relying on very simple allocations which will, if anything, slightly overstate costs – and this is more than sufficient to help our client make better decisions.

The Bottom Line – This project is still in process, yet Gamma has already benefitted from:

- Shop and job process improvement opportunities identified through the process review preceding the workflow system development.

- Insights about what drives costs and how to better manage these.

- Ideas for further process improvement and cost reduction.

Finally ...

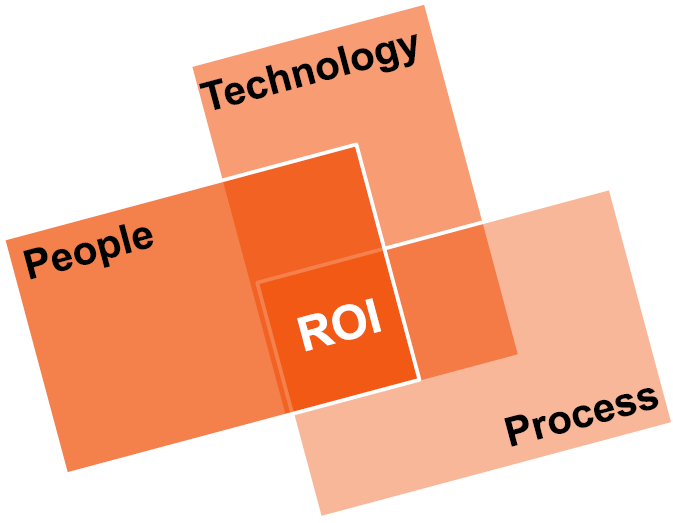

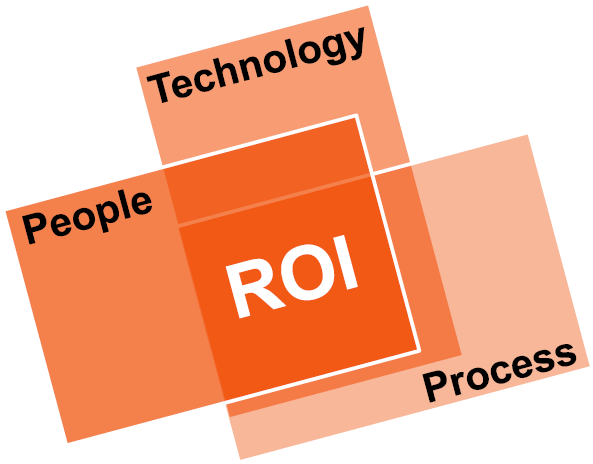

While our work consists of a WIDE variety of ways to better align People, Process, and Technology (PP&T), for improved Results (represented by ROI) ...

Before

LOW Alignment of PP&T

After

HIGH Alignment of PP&T

... we never forget our job is to increase the size of the ROI rectangle and thus ...

OUR Bottom Line – We help companies grow THEIR bottom line.

Could your bottom line use some growth? If so, please contact me, and let's discuss whether our Systems and Cost Accounting prowess can help.

Sincerely,

Todd L. Herman