Many service providers will refer to the companies and persons they serve as "clients" instead of "customers." What's the difference? Does it make a difference?

I was recently part of an interesting discussion about the services a firm similar to mine (let’s call them Beta) provided – or failed to provide – for their client (Alpha). The question being tossed around was whether the service provider had a “fiduciary duty” to act in their client’s best interest.

"Fiduciary Duty" vs. "Ordinary Care" or Even "Caveat Emptor"

While I am not an attorney and thus cannot definitively say what standard of care Beta owed Alpha, I can say one thing with absolute certainly – there was NO "fiduciary duty" involved. Why?

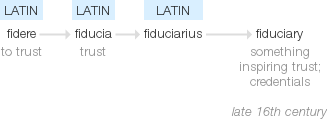

It helps to take a look at the origin of the word "fiduciary." A Google search brought up this image, based on information from Oxford Dictionaries:

As you can see, the origin traces back to Latin words meaning "to trust" or "trust." Thus, a "fiduciary" is someone you can trust to act in your best interests. This is especially true in providing services, where potential conflicts of interest arise more easily than when selling products.

If a seller of goods or services does not owe you a fiduciary duty, then what duty is owed? The answer – a standard of ordinary care, as practiced by a reasonable person.

Remember, I'm not an attorney – even so, a standard of "ordinary care" is much lower than a standard of "fiduciary duty." Here's an example vividly illustrating the difference.

In the months before and leading up to June 9, 2017, Wall Street firms and various investment advisers were aggressively lobbying the Department of Labor (DOL) to further delay (which had already happened at least once) – or kill – rules proposed by the Obama administration applicable to companies or individuals working with retirement accounts, including traditional and Roth IRA's. Why was this? Well, if these rules were to take effect, affected firms and advisers would be required – by fiduciary duty – to choose investments best for their client, and such investments did not necessarily pay the high fees those firms and advisers were currently earning.

Keep in mind, the DOL rule applied only to retirement accounts – it did not apply to regular investment accounts. For typical accounts, current standards of care would continue to prevail. Depending on the investment being considered, the best advice might be "let the buyer beware" – or, in Latin, "caveat emptor."

"Client" vs. "Customer"

A service provider may call you a "client" – but, how accurate is that?

Looking at the word origin of "client" is helpful:

The first definition of client provided by Oxford Dictionaries is this:

- A person or organization using the services of a lawyer or other professional person or company.

In the same article, the "Origin" section includes this important statement:

The term originally denoted a person under the protection and patronage of another, hence a person "protected" by a legal adviser.

That makes sense – you typically retain an attorney to protect yourself or something important to you, and thus will probably heed the advice given.

If you're not a "client," what are you? I would consider you to be a "customer" of regular commercial transactions, even if these are services from providers who refer to you as their "client."

What's the Big Deal?

You may be thinking, "Okay, Todd, I follow everything so far. Still, I don't see how these concepts are related."

So, let me boil it down to how I view these concepts:

- The way I see it, you are a "client" and thus entitled to a standard of "fiduciary duty" if and only if the service provider is regulated or licensed by the federal government or a state government, and the statutes or regulations covering that service provider require the provider to act in the best interests of those being served.

- And ... if all of the preceding conditions are not met, you are merely a "customer" and thus owed – at most – a standard of "ordinary care."

What regulated or licensed service providers are typically required to act in their clients' best interests? Attorneys, CPAs, and medical professionals certainly come to mind. I'm sure other professions have similar requirements covering all their services, or at least some of their services (for example, investment advisers servicing retirement accounts).

"The most trusted option"

In the discussion I mentioned at the beginning of this article, it seems Beta started off providing services conforming to, or even exceeding, Alpha’s expectations. At some point though, Beta appears to have gotten in over their heads, failed to inform Alpha’s executives of this, and eventually lost the trust of their client. Since Beta is not regulated or licensed by a governmental entity, they had no "fiduciary duty" to act in Alpha’s best interests.

I frequently recommend the outstanding book, The Referral Engine: Teaching Your Business to Market Itself, by John Jantsch, for its business development insights for firms like mine. Interestingly, the author lists as the very FIRST quality of a referable business is to be "The most trusted option" (page 13).

The author explains this further:

- Trust is earned by keeping promises: tangible things like delivering on time, paying bills on time, and honoring guarantees; and less tangible things like authentic marketing messages, caring service, and a culture of respect.

- Trust is also lost by overpromising. I'm not suggesting that you shouldn't aim high, but I am suggesting you must know what you are capable of doing and do what you say you are going to do. It sounds so simple, yet it's the number one reason people lose faith in businesses and in entire industries.

- When you have trust – earned by keeping your promises – you can make mistakes, own up to them, and correct them without loss. One of the hallmarks of a highly referred business is that they work as hard on fixing mistakes as on any other aspect of their business. (page 14)

No service provider wants to have a tough conversation with a client. Still, it’s better to have such a discussion while the problem is small and fixable, rather than wait and hope the problem resolves itself. Hope is not a strategy, because it doesn’t change anything. Mistakes will compound and problems will snowball.

Trust Is Built Into THA's DNA

I've written several articles over many years touching on various points in this article, including:

- "qual·i·ty" – Quality is defined by the buyer of products or services.

- The Efficiency of Trust – Building trust in business relationships is not just the right thing to do, it's also the most efficient way to do business.

- No Guessing. No Surprises. Tell the Truth. – My firm's unofficial motto.

I believe that trust is built into my firm's DNA. That certainly stems both from who my firm members and I are, and from professional standards and state regulations applicable to CPA firms (yes, my firm is a CPA firm and I am a CPA – I just don't typically mention this in my marketing, since we only provide business technology consulting services, unlike the attest and tax services offered by most CPA firms).

Thus, my firm is held to a higher standard than a typical technology services firm, and the companies and individuals we serve truly are "clients" because we are obligated to act in their best interests. Do I sometimes wish this were not so? On occasion – sure, especially if I believe a prospect got sold a bill of goods by someone else. Yet, I firmly believe that acting in our clients' best interests is a key to our longevity, and to our business development philosophy relying almost exclusively on referrals.

Trust and Truth

I often go back to a comment made by the controller of one of my auditing clients at Arthur Andersen & Co. early in my career: "Despite the scarcity of truth in the workplace, the supply still exceeds the demand." Dick's comment was both witty and wise. It is better to supply truth to a client, even if they're not demanding it – because, at some point, they will demand truth and then it will be too late, since the client will no longer trust you.

Whether you’re a “customer” or a “client,” you deserve to be able to trust your service provider – however, since only certain service providers are required to act in your best interests, only true “clients” are owed the truth, however inconvenient it might be.

Sincerely,

Todd L. Herman