For background on this particular project, please visit Great People + Manual Process + Questionable Technology = Poor Results.

Situation ...

This insurance company had an industry-specific business system, and a separate accounting system. Management was concerned because their business system lacked detail to audit its results, and a thorough review of the underlying processing had not been done.

Problem ...

Initially, the problem seemed to be a lack of integration between the business and accounting systems. While performing the business and systems analysis phases of the project, however, we conclusively determined the business system was producing inconsistent results – and this determination validated management's concerns about the reliability of the business system. The lack of integration and amount of intervention raised internal control concerns with the auditors, which they voiced in their management letter.

Solution ...

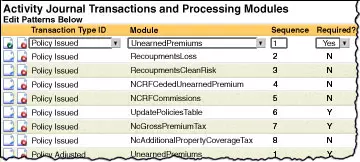

We worked with this system's vendor to enable them to write basic business events as transaction records to an "activity journal" in a format we specified. We then used the records in the activity journal – reflecting events such as "Policy Issued" and "Policy Adjusted" – in two ways:

- As measures of processing accuracy of the main business system.

- As inputs to the transaction-driven integration system we developed.

In the first instance, we developed routines to scrub the data for unusual values, and then worked with the system vendor to:

- Identify and have them correct processing issues flagged by our data-scrubbing routines.

- Re-process any incorrect transactions.

In the second instance, we worked with client personnel to understand the accounting transactions – and associated level of detail – to support both financial accounting and statutory reporting requirements. We then developed the setup tables, processing routines, output tables, and integration steps to automatically prepare all required accounting entries for the premiums processing and claims processing cycles.

The system evaluates each record in the activity journal and then processes one or more modules to prepare accounting transactions, based on the underlying transaction type. An individual transaction can generate up to 300 accounting records.

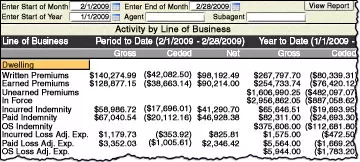

Managers can run activity reports by line of business on demand, selecting date ranges, agents, and subagents of interest.

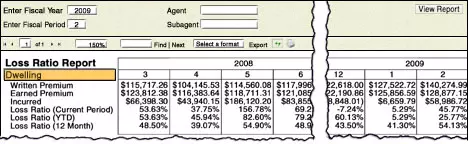

Managers can analyze their loss ratio – a key to successfully managing an insurance company – for the current period, current year-to-date, and trailing 12 months.

Results & Benefits ...

Management now has much greater confidence in how its business system handles transactions, and has greatly improved analysis capabilities to knowledgeably manage their complex business. Our solution not only produces fully supportable detail for every business event – it also provides intelligently designed reports and analyses to summarize detail and quickly present relevant information on trends and anomalies.

Furthermore, this project laid the groundwork for integrating future business systems where, once modified, the resulting activity journal transactions will be processed under the same business rules and routines already in place.

Conclusion ...

Executives, managers, and accountants can now confidently and intelligently plan, run, manage, and evaluate their operations against their overall business strategy, while satisfying the information needs of various stakeholders.

For More Information ...

To discuss how technology usage and business process improvements could be applied to the issues facing your business, call us at 336.297.4200 to schedule a no-obligation consultation, or click here to contact us online.